My Revenue Plan

6 steps to double your revenue in 2024, without burning the midnight oil.

12-15 min read.

Welcome to My Revenue Plan

Many business owners try to do too many things at once. They waste time and energy chasing growth strategies that don’t work for them. As a result, they feel overworked and stressed out. This is unsustainable... But there’s a way to fix it.

The truth is, you don’t have to burn the midnight oil to grow your revenue and increase profit. You can do less things, but do them better. You can work smarter with what you already have and enjoy more revenue without sacrificing your freedom or sanity.

Your revenue growth plan doesn’t have to be complicated either… Instead of trying many things and hoping something will work, follow the 6 proven steps I’m about to share with you and you will not only see growth, you will position your business to scale.

Here are the 6 key things you have to do if you want to grow your revenue this year:

1. Align your team around 3 priorities

2. Clarify your marketing message

3. Build a sales funnel

4. Prioritise profitable products

5. Streamline your operations

6. Install a cash flow system

If you’re struggling for time or lacking focus, a Leader Guide Coach can help you implementing these steps with certainty.

Doubling your revenue is not as impossible as it seems. If you implement this plan and stay committed to focusing on the things that matter, you will break your own revenue record and unlock the full potential your business has to offer.

Here’s to growing your business,

Lachlan Nicolson

Director of Leader Guide.

Book A Call

1

Align your team around 3 priorities

Growth depends on your team members buying into a common goal and maintaining focus to achieve it. When your team is not aligned and running in different directions, achieving almost anything feels impossible. On the flipside, a team that’s aligned and focused can achieve remarkable results, even when the odds are against you.

I’m guessing you want to be the latter – a small business owner with a winning team, making a significant impact. Your team members want that too.

More goals, more project boards is not the answer — that’s busy work. The key is prioritising the things that matter most and ruthlessly executing on them.

“Do less things, but do them better”

I recommend abiding by the ‘Rule of 3’. Choose 3 economic-grounded priorities each quarter, and break those down into smaller week team and daily individual priorities.

For example: A priority for a local tyre shop might be to sell 600 pairs of car tyres in a quarter as a team. That’s 200 a month, or about 50 per week, 10 per day (Mon-Fri). Keep it simple.

Priorities create intentionality and help you direct resources to where they need to go. The biggest resource being employees’ time. But if everything is a priority, then nothing is. Research suggests our brain can hold 3 things front-of-mind, but anything more and we lose focus.

Free Resource: 90 Day Action Plan Template

ACTION STEPS

Choose 3 clear priorities for the next 90 days. Get team buy-in.

Train your team members to create their own 3 daily priorities.

Focus on your priorities each and every day. Lead by example.

2

Clarify your marketing message

We spend more of our waking hours daydreaming than you might think. Up to one third of our day literally daydreaming — as one study suggests. We do this because our brain is wired to conserve mental energy for our survival.

Consumers are flooded with thousands of marketing messages everyday. It’s no surprise then, one of the biggest challenges in marketing today is capturing people’s attention long enough to communicate a message.

So how do we cut through the noise so that customers listen? The answer is surprisingly simple: clarify your message using story.

A clear message sells products, and story is the best way to package that message to customers. Humans have been telling stories for thousands of years.

“Story is the default language by which our brain makes sense of the world.”

When you learn to communicate your brand message using the elements of narrative story, you will cut through the noise and connect with customers in a deep and meaningful way.

At Leader Guide, we’ve helped many businesses clarify their marketing messaging using a story framework called StoryBrand. You can learn more about this framework by reading the book ‘Building A StoryBrand’ or course by Donald Miller.

A clear marketing message should articulate 3 things:

The problem your customer is experiencing

How your product solves that problem

The positive results your customer will experience when they buy

A clear message is the most valuable asset in your marketing. And it’s worth investing in a Coach to help you get it right. When you clarify your message using the power of story, customers will listen and your business will grow.

ACTION STEPS

Read the book Building A StoryBrand by Donald Miller.

Filter your marketing messages through the 7-part StoryBrand framework.

Be clear. Avoid using cute or clever words/slogans on your website.

3

Build a sales funnel

Once you’ve got a clear marketing message, you need a way of communicating that message over and over again to generate and convert leads. The best plan to do this is with a sales funnel, sometimes referred to as a marketing funnel.

A funnel is a systematic approach to taking someone from being a stranger through to a paying customer. Funnels guide people through a process whereby they build trust with your brand and overtime become more likely to make a purchase. Without a funnel, you will exhaust yourself trying to convert leads into customers one by one and not have predictable revenue.

“A funnel takes someone from being a total stranger to a paying customer”

Funnels follow human behaviour. There are three main stages of any funnel, that work in the same way human relationships are formed, which are:

1. The Awareness Stage

2. The Engagement Stage

3. The Commitment Stage

Think about human relationships: We first have to know about someone (Awarness), before we get to know them, build trust with them (Engagement), in order to form a healthy relationship (Commitment).

The benefit of a digital sales funnel is that you can reach hundreds, even thousands of people, without spending a lot of money or effort. At Leader Guide, we’ve built dozens of sales funnels for our clients that run on autopilot, generating thousands of leads and paying customers.

Your sales funnel starts with a free, valuable resource (a lead generator). This could be a 15min phone call, video series, or PDF guide, in exchange for a name and email address.

The benefit of a digital sales funnel is that you can reach hundreds, even thousands of people, without spending a lot of money or effort. At Leader Guide, we’ve built dozens of sales funnels for our clients that run on autopilot, generating thousands of leads and paying customers.

A good sales funnel starts with a free, valuable resource (a lead generator). This could be a 15min phone call, video series, or PDF guide, in exchange for a name and email address.

From here, you want to develop strategic emails with psychological triggers that motivate people to buy. These emails can run automatically over the space of a month, or more, depending on your product and average sales cycle.

The truth is, people buy when they’re ready to purchase, not when you’re ready to sell. The role of a sales funnel is to remind customers of the problem they have (and the pain it’s causing them) – and that gets them ready to purchase.

It can take some adjustments to get your message and frequency dialled in right, so that your sales funnel is neither too pushy or too passive. If you come across too strong, customers might back away from the conversation. On the other hand, if you never confidently ask customers to buy, they won’t.

Need help building a digital funnel? LeaderWeb

ACTION STEPS

Create a valuable free resource to giveaway in exchange for emails.

Write 6-10 nurture and sales emails for your automated funnel.

Run ads to your funnel landing page (not website home page).

Add clear call to actions that encourage customers to buy.

Work with a Coach or marketing Consultant to fine tune your funnel.

4

Prioritise profitable products

Do you know where your profit is coming from? You may have products that generate a lot of revenue, but do you know which ones are actually profitable, if at all? Have you ever back-costed a product or service to find out?

Sadly, many businesses are spending more time and money than they realise on product creation and delivery. In some cases, certain products are costing more money than they are creating profit.

If you want to double your revenue and make more profit, you need to evaluate the profitability of your products so that you can know what to focus on selling.

This process can be done by an accountant, or you can keep it simple and use a spreadsheet like the one below to quickly assess which products generate the most profit per unit.

First, you want to clarify:

What is the price of the product?

Then, (approximately) calculate the associated costs:

What does it cost to produce?

What does it cost to sell and market?

What does it cost to distribute?

What does it cost to provide support?

The price of the product minus the total costs (approx) leaves you with the profit $ per unit. It’s okay if you use rough figures first (better than flying blind), before handing it to your accountant to do more advanced calculations.

If you’re unhappy with the profit margin on your products, work with a Leader Guide Coach to optimise your products for more revenue and profit. They have strategies to help.

Access the Product Profitability Audit Worksheet (FREE)

ACTION STEPS

List all your products and services

Calculate the costs and profit per unit

Review the findings and discusss options (scale up, cut back)

Focus on your top 3 most profitable products

5

Streamline your operations

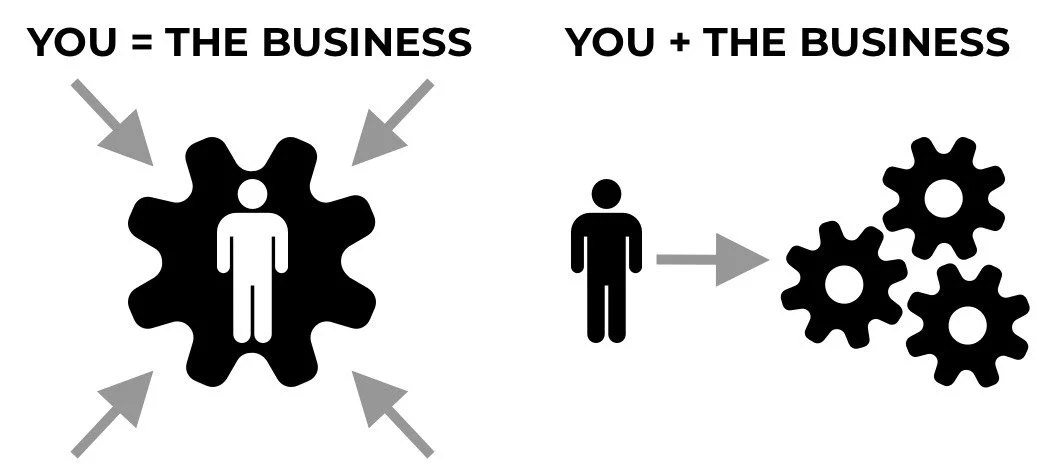

How does work get done in your business? Do you have systems to manage the growing workload? Or are YOU the system?

There comes a point where the business owner realises they need to install systems and processes – so that they can stop being the bottleneck and start scaling the business sustainably.

When you add more customers, products and team members, things can quickly turn to overwhelm and chaos. That is, unless you have systems and processes to rely on.

Systemising your business has many benefits:

Reduces inconsistencies and errors with work

Removes bottlenecks (starting with you)

Improves scalability

Improves profitability

Increases flexibility to seize opportunities when they come about

Increases your business value if/when you sell

In other words, systems and processes are the key to streamlining your operations.

But not all systems work as they should… This is because many business owners try to create systems without a framework and end up over complicating things.

In my book OFFLOAD, I share a simple 3-step process for creating systems and processes before integrating them into your business:

Step 1. Outline your Key Systems

Step 2. Identify the Critical Actions that make your business run

Step 3. Create step-by-step processes for each Critical Action

You can read these steps in detail in the book. Available on Amazon.

When you streamline your operations, your business will run better, causing you less stress and enabling you to scale it with success.

Recommended Reading:

Systemology by David Jenyns

Clockwork by Mike Michalowicz

ACTION STEPS

Do an audit of your current systems and processes. Are they working?

Identify the critical actions that make your business run.

Create step-by-step processes for each critical action.

Work with a Coach to integrate your systems and processes.

6

Install a cash flow system

Cash flow is the number one thing keeping small business owners up at night. But it doesn’t have to be… The fix to most of your cash flow worries is simple: Install a cash flow system using just your banking accounts. Doing so will help you make better financial decisions each day in your business and get ahead of cash flow problems as they arise.

You might be thinking, “how does a cash flow system help me double my revenue?”... It all comes down to focus. What you focus on is what you receive.

Many business owners are not really focused on their business finances daily. Sure, they check the bank account each day and see a heap of money sitting there — but they don’t know how much of that money is for tax, payroll or profit.

Your cash flow system doesn’t need to be complex. Leave complex for your accountant meeting each quarter! Coaching business owners, I’ve found that having a few specific bank accounts where money is allocated to each month makes a huge difference to their sanity. And the best part is, you can set these accounts up in minutes from your internet banking.

For example:

Account #1: Operating Expenses (Opex) – Where all your business income and bills get paid, including contractors or payroll if you have full-time staff. This will be a transaction account with a debit card.

Account #2: Profit Account – Holds profit and acts as an emergency buffer for cash flow crunches.

Account #3: Tax Account – Holds taxes to be paid.

Account #4: GST Account – (For Australian businesses) Holds GST owing to be paid.

Account #5: Investment Account - A place to hold funds for the business to invest into other income producing assets.

The last account is an Owner’s Expense Account – This should be a separate personal account where the owner of the business (you) gets paid a set wage and lives off that only.

Once you’ve got your accounts set up, start automating allocations each cycle. For example: On the 1st of each month, money for taxes is transferred from Opex to the Tax account.

The same applies to profit. You have to protect profit by keeping it out of your Opex account where it’s likely to get spent. Mike Michalowicz, the author of Profit First says profit is not an event, it’s a habit. It has to be ‘baked into your business, in every transaction and moment’.

“Profit is not an event, it’s a habit”

When you have fine-tuned cash flow system, it allows you to quickly see how much cash you have to operate your business, giving you instant clarity over the current financial health of your business (instead of waiting for a quarterly P&L report) and motivation to make changes quickly and improve or resolve foreseeable cash flow problems.

Good cash flow is the foundation for healthy revenue growth. It allows you to manage more incoming revenue and outgoing expenses with clarity and sanity.

To dive deeper into this topic, I recommend reading Profit First by Mike Michalowicz.

Recommended tools: Fathom

This is not financial advice. Start a conversation with your accountant and financial advisor about your business finances and strategies.

ACTION STEPS

Speak to your Accountant &/or Financial Advisor about your business cash flow.

Set up multiple bank accounts within your business banking system.

Calculate and automate transfers between accounts each cycle.

Protect profit by quarantining it from your Opex account.

Grow your business with a trusted guide.

Why risk going alone?

A Leader Guide small business Coach makes running a business simple and enjoyable.

We can help you build your business the right way so that it runs well and you can enjoy more freedom and flexibility as you grow.

More Resources

Offload book

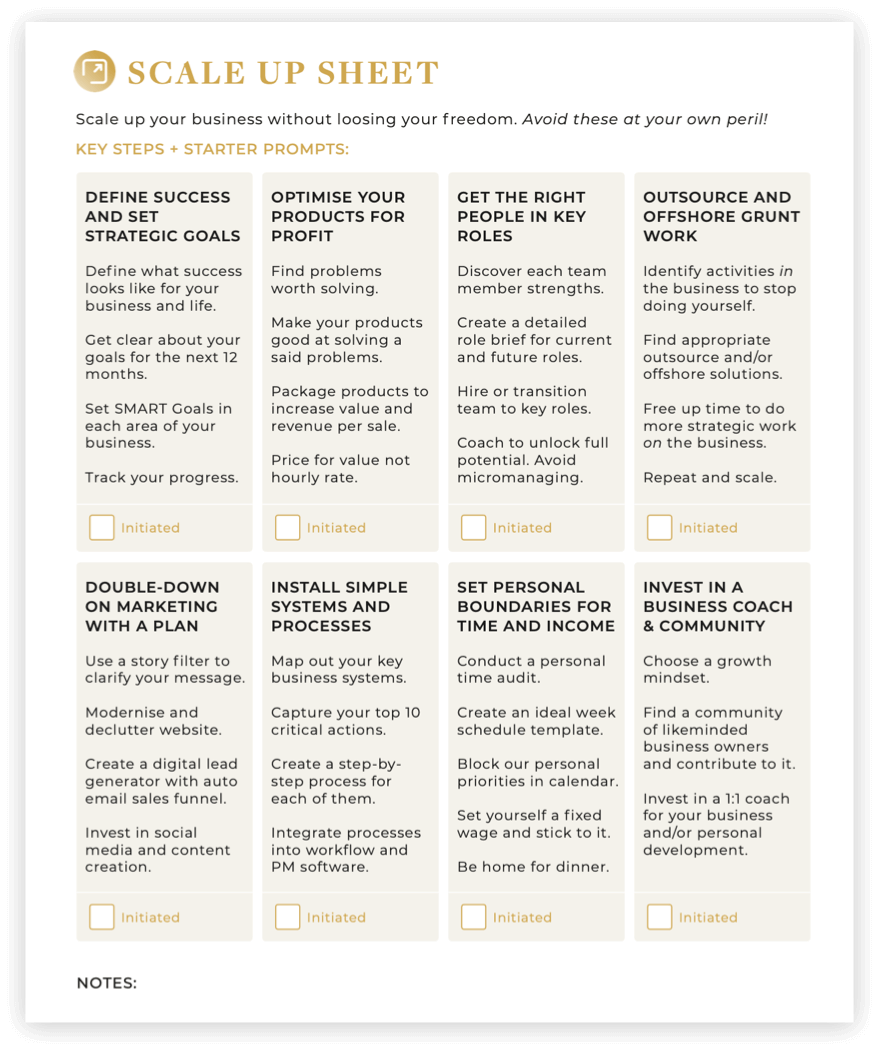

Scale Up Sheet

Follow these 6 steps to scale up your business without losing your freedom.

Growth Guide

Discover the 5 stages of small business growth and the key steps to navigate them.